Scaling to New PV Technologies Leads to Rise in Module Reliability and Quality Concerns

By George Touloupas, Joseph C. Johnson, and Aditya Vardham

This article was originally published in pv magazine – June 2021 edition, titled, “Firm foundations on shifting sands.”

Unprecedented capacity expansions and massive technology changes, all at a frantic pace, signal that PV is entering the Terawatt era. However, challenges in supply and demand imbalances across the value chain, combined with emerging technical and quality risks, require detailed analysis and due diligence from buyers to avoid pitfalls.

Module Supplies are Quickly Outpacing Upstream Segments

Module capacities vastly exceed upstream stages of production and current year demand due to module factories being able to be brought online faster, and with lower CapEx requirements, than cell, wafer, ingot, or polysilicon facilities. Major factories from Tier 1 players completed and fully ramped at the end of 2020 in anticipation of a 2021 recovery in solar demand.

The chart below depicts Clean Energy Associates’ (CEA) estimates for potential production which can take place in 2021 based on available and online manufacturing capacities at each stage of production, without considering input restrictions.

2021 Available PV Production Capacity vs. 2021 Forecast Installations; Source: Clean Energy Associates Supplier Benchmarking Program

Module capacities exceed all other stages, and even if all polysilicon capacity is fully utilized, there is almost 90 GW or 35% more module production than polysilicon production once thin film technologies are removed from module production outlooks. On the demand side there are similar conditions where module supplies exceed even optimistic estimates for 2021 installations by nearly 100 GW.

Due to the mismatch between module production capacity and both upstream limitations and downstream demand expectations, some module production must go unused with module expansions overshooting the rest of the industry. With lacking demand, some suppliers are likely to slow production, idle some lines, and delay some new expansions to keep fleets online until the rest of the industry can catch up to the module production segment.

Solar Manufacturers Shifting Focus Back Towards Cell Efficiencies

When the M6 (166 mm) wafer was first launched in late 2018, it was expected to reign as the market standard for a while. However, things quickly changed after Zhonghuan launched their G12 (210 mm) wafer in late 2019, which was followed by the launch of the M10 (182 mm) wafer. The M6 wafer now stands at risk of being phased out as early as 2022 or 2023 and is very likely to only remain as a ‘transitionary’ wafer size.

Manufacturers have been very quick in forming alliances based on their preferred choice of wafer sizes and launched the mass production of these larger wafer products. Most mainstream manufacturers have announced grand plans for 2021, with several of them even announcing 20+ GW of new module capacity for these larger wafer products.

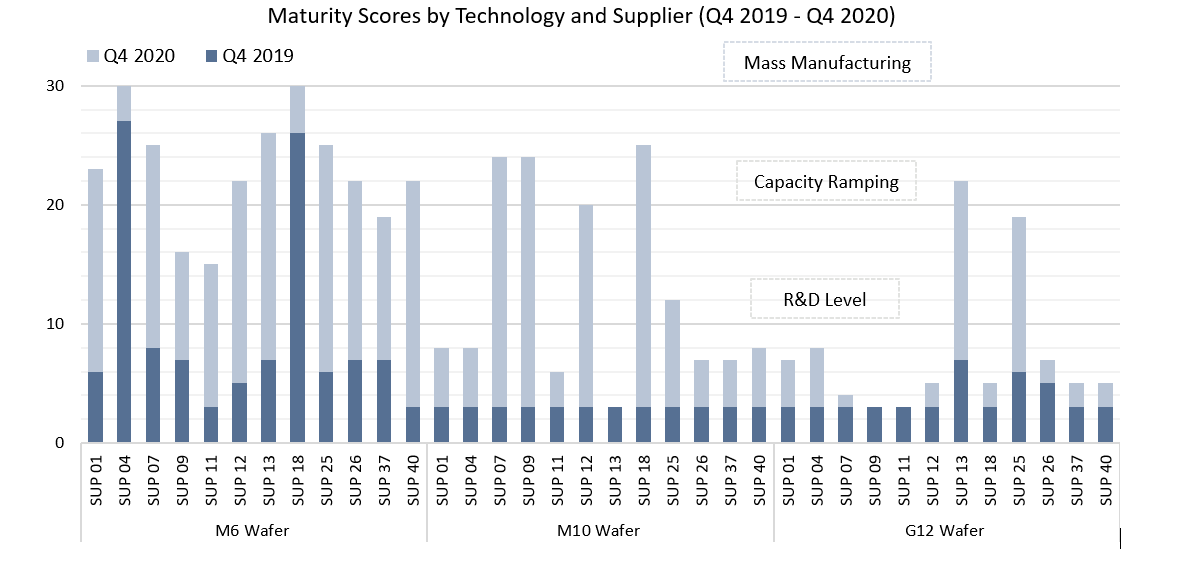

CEA introduced a new ‘maturity score’ metric in the company’s PV Supplier Market Intelligence Program, which can be used to compare suppliers based on the Manufacturing Readiness Level (R&D phase), Capacity Scale (ramping up phase) and Track Record (shipment scale) of different technologies, with scores ranging from 1-10 for each of these 3 stages, for each technology area.

The rapid adoption of these new wafer sizes can be seen in the chart below, which visualizes the change in maturity scores of suppliers for these wafer sizes between late 2019 and 2020.

Maturity Scores by Technology and Supplier; Source: Clean Energy Associates Supplier Benchmarking Program

The rapid uptake of larger wafers and new module formats has had a significant impact on auxiliary component supply chains like that of glass, encapsulants and backsheets. While polymer supply chains eventually managed to catch up with these changes, prices are still in a stabilization period.

Considering these issues, the alliances came up with a standardized set of module layouts, for both the utility and residential markets. Additionally, manufacturers are adopting interconnection technologies like paving or shingling for higher module efficiencies and optimized material use.

All these module level changes were motivated by the desire to offer the lowest levelized cost of electricity (LCOE) for the end user. After mainly focusing on innovations at the module level, manufacturers are now expected shift their focus back towards improvements in cell efficiencies and technologies, such as n-type.

Over 150 GW Of New Module Fabs Announced for 2021

Just five suppliers, LONGi, Jinko Solar, Canadian Solar, Risen, and Talesun added over 28 GW of new module capacity between Q4 2020 and Q1 2021. In line with broader industry growth trends, many other suppliers also announced nameplate capacity increases in 2020 which are scheduled to come online this year.

Currently, CEA is tracking just over 150 GW of nameplate capacity expansion announcements for module factories which are expected to complete by the end of 2021.

Of the 150 GW of new expansions, Trina Solar, Canadian Solar, LONGi, Risen, and JA Solar constitute nearly half of new module production, with other major players like Jinko Solar spending 2021 ramping new cell facilities following rapid module expansions completed in 2020.

Module Capacity Expansions and Nameplate Increases in 2021; Source: Clean Energy Associates Supplier Benchmarking Program

Over Capacity and Low Utilization a Rising Concern

While large suppliers with sizeable expansions are foregoing updates to facility nameplate figures, we expect even more production capacity to be available once module equipment is fully utilizing larger M10 or G12 cell inputs.

Almost all new module factories are expected to be capable of producing up to a G12 format product, and any factory limited to a M10 product is likely to be easily upgradable if a clear wafer size preference develops in the market. Most factories finishing construction in 2020 were also designed with new format products in mind, and availability for large format products in most markets is anticipated to surpass all market demand by the end of the year.

Major suppliers maintain expansion plans, but with module capacity gluts developing, there are doubts that all supplier expansions plans will materialize on time and at a scale matching initial factory announcements.

For the largest suppliers in the industry, significant over capacity and low utilization can be maintained in the short term if financing costs are low and if profit margins other segments of the suppliers’ fleets can support idle lines. For these suppliers, construction on new, multi-gigawatt facilities in China is currently underway and unlikely to deviate from initial plans. However, as high module costs are expected to persist throughout 2021, current conditions are certainly challenging for emerging suppliers which hoped to run new factories at full capacity.

Module Reliability and Quality Concerns Grow With Rapid Industry Transitions

Reliability concerns have been prevalent ever since the industry started moving away from mainstream technology such as modules with full cells from G1 (158.75 mm) wafers, 5 busbars, and cell interconnection with a 2 mm gap.

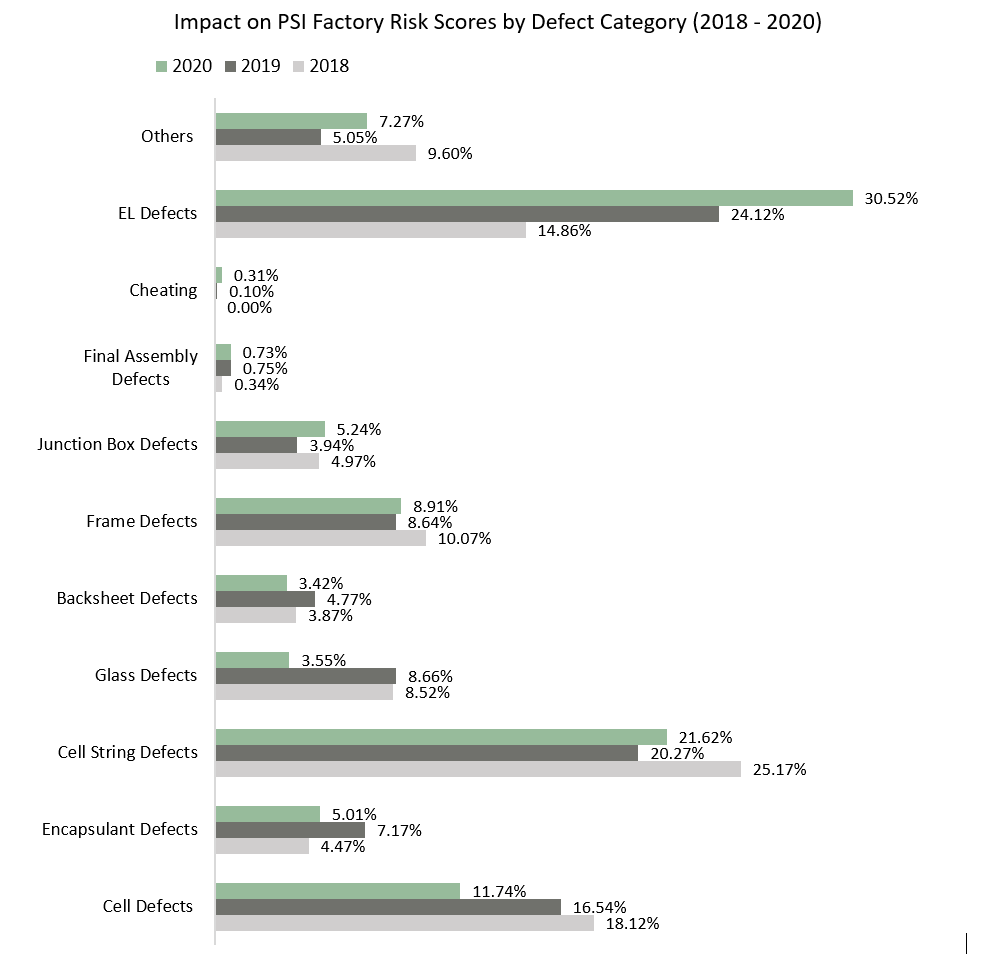

Pre-Shipment Inspection quality metrics from CEA’s Supplier Benchmarking Program, shows a clear rise in quality issues and associated risk scores for inspected modules from 2018 to 2020.

As seen in the chart below, the impact of the EL defect category (primarily microcracks and poor soldering) on the factory risk scores has almost doubled between 2018 and 2020. During the same period, the industry went through a transition towards larger wafers, half-cut cells, multi busbar technology and reduced inter-cell spacing. These advancements largely led to, among other issues, tabber-stringer malfunctions and subsequently much higher EL defect rates, exacerbated by the mass ramping up of GWs of new production lines, which typically take months to stabilize.

Impact on Pre-Shipment Inspection Factory Risk Scores by Defect Category; Source: Clean Energy Associates Supplier Benchmarking Program

The new wafer sizes and larger module dimensions can make the module more susceptible to mechanical stresses, especially in high wind or snow regions. Amongst the dense interconnection technologies that are used in the latest modules, tiling has already had several long-term reliability concerns in the form of excessive stresses and microcracks which discouraged many manufacturers from adopting this technology. Paving on the other hand can also have reliability concerns unless damage free laser cell cutting and thicker encapsulants are used.

The rapid introduction and adoption of new technologies along with aggressive ramping of capacity, as in the case of the larger format modules, can certainly cause several reliability concerns along the way. This concern is even more severe in the case of suppliers with smaller track records, since they might have to go through steep learning experiences accompanied with process instabilities, high defect rates and low production yields.

Increased Due Diligence Required During New PV Product Procurement

Of course, all these new PV module products must be certified according to UL or IEC standards before being produced, however, it is generally accepted that these testing standards are following a “minimum bar” approach and are not considered to be adequate to evaluate the performance and reliability of PV modules for 25 years or more in the field.

Extended Reliability Testing More Rigorous Than IEC

Extended Reliability Testing (ERT), which goes beyond the Ul and IEC requirements, is generally accepted to be a suitable approach to a more rigorous evaluation. There are several ERT protocols that are being used globally to test modules, such as PVEL PQP, RETC PQP, TÜV Sud Thresher, CSA C450 etc., and the newly published IEC TS 63209-1 standard is attempting to unify these.

Extended Reliability Testing takes six to eight months to be completed, and it must cover all Bill of Material (BoM) variants that a supplier uses. So, by design, ERT requires careful planning and investment from suppliers. The current challenge is that the proliferation of product variants, and the need to use alternative BoMs because of raw material bottlenecks, creates situations where procurement decisions need to be made before ERT is completed for all candidate products and BoMs.

Additionally, production lines must overcome lengthy ramp up periods, where process instabilities, for example at the tabber stringer station or during lamination, can result in excessive quantities of inferior product being produced and shipped to buyers, unless a robust PV Quality Assurance program is applied both before and during production, and before products are shipped.

Buyers are therefore advised to be more proactive in performing due diligence when it comes to new product procurement decisions, as, although all these new technologies are great for reducing LCOE, such claims for LCOE improvement are only valid when products are reliable and last for their designated lifetimes, producing the expected energy yields.